The GST Collection August 2025 shows a big jump, showing India’s strong economic recovery. The numbers are up from last year, beating expectations. This shows India’s economy is doing well, even when the world is slow.

This growth is more than just good tax numbers. It shows a bright future for India’s economy. Looking at these numbers helps us understand India’s economic health and why good tax collection is key.

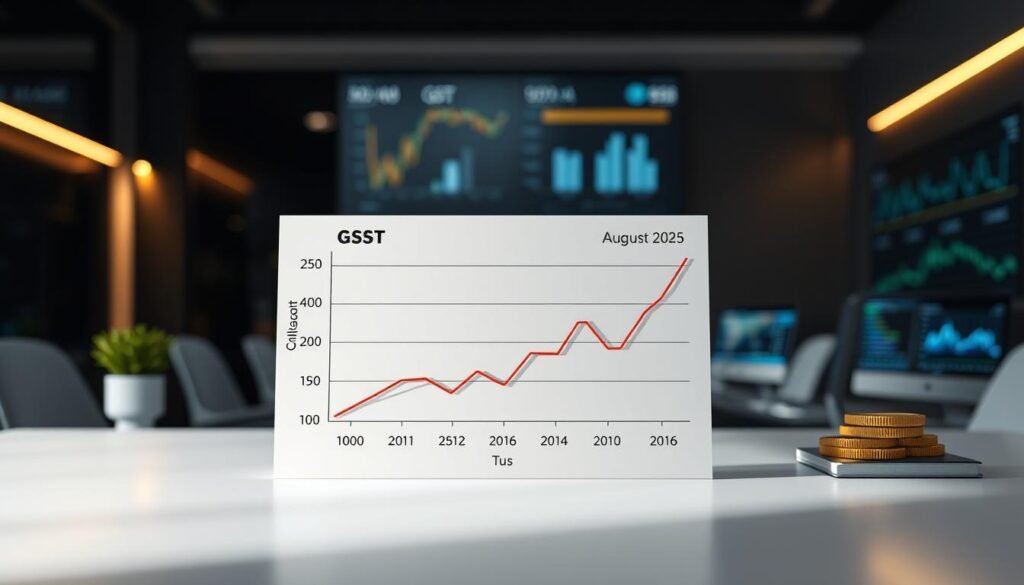

Overview of India’s GST Revenue Trends

India’s Goods and Services Tax (GST) has seen big changes from the start. Looking at the trends, the GST India August 2025 numbers are key. This month, tax collection in India went up, showing a bright future for the economy.

This rise shows a strong economic recovery India. It means more people are spending money and businesses are doing well.

Important events have shaped GST collections over time. Rates and rules have changed, making things clearer and more efficient. The numbers for August 2025 are higher than before, showing India’s financial system is strong despite global challenges.

By looking at these trends, we see how well India’s money system adapts. Monthly numbers tell us about the economy’s health. Yearly comparisons show growth over time. The better tax collection India shows a big effort to improve, boosting hopes for a lasting economic recovery India.

GST Collection August 2025: A Detailed Analysis

Understanding GST collection is key to seeing how India’s economy is doing. For August 2025, we look at the important parts that show how GST is doing. We also see the trends in the data.

Breakdown of GST Components

In the GST Collection August 2025, we see a few big parts:

- Central GST (CGST): This is the money the central government gets. It helps fund public needs.

- State GST (SGST): This money goes to states. It helps with their projects and initiatives.

- Integrated GST (IGST): This is important for trade between states. It makes sure taxes are right.

Each part is important for the total GST collection. They show how different sectors are doing and what people are buying.

Comparison with Previous Months

Looking at GST collection over the last few months gives us clues. By comparing July 2025 to August 2025:

- August saw more money coming in, showing businesses and people are doing well.

- Important areas like making things and services were more active. This helped the money coming in.

- Seasonal changes, like holidays, also affected the numbers. People spending more during these times helps.

This close look helps us understand what makes GST performance good in a recovering economy. It gives us a full picture of the current money situation.

Factors Contributing to Strong GST Growth

In August 2025, several key factors have boosted GST performance in India. This growth shows a strong connection between government actions and changing consumer habits. These elements are vital for India’s economic recovery. They also help in increasing tax collection.

Government Initiatives and Reforms

Recent government reforms have greatly improved GST efficiency. Important steps include:

- Improved compliance measures that make reporting easier and cut down on taxpayer stress.

- Digital tax filing systems that make processes smoother and encourage on-time payments.

- Increased outreach programs to teach businesses about their GST duties.

These efforts have not only made following GST rules easier. They have also increased public trust, which has positively affected GST performance.

Consumer Spending and Market Sentiment

Consumer sentiment has improved a lot, greatly affecting market demand. This change is due to:

- Heightened economic stability making consumers more confident in their spending.

- Increased disposable income from more jobs and higher wages.

- Shifts in preferences towards more expensive goods and services, showing market optimism.

This rise in consumer spending has led to a positive trend in tax collection. It shows a strong connection between economic recovery and better GST figures.

Impact of Global Economic Conditions on India’s GST

The global economy has a big impact on India’s GST collection, as we get closer to GST India August 2025. Things like international trade, currency changes, and supply chain issues can change how much tax India gets. These factors can help or hurt India’s economic growth.

Global economic changes affect India’s manufacturing and exports a lot. If the world market slows down, there’s less demand for Indian goods. This means less money for companies and less GST for the government, hurting the economy.

Currency changes are also key. A strong rupee makes Indian products pricier abroad, which can lower demand. But a weak rupee might make Indian goods more competitive. This shows how delicate the balance is in India’s economy, facing global challenges.

Looking at how global conditions affect GST, we see the need for smart reforms. Watching these trends helps us understand India’s economy better and what the future might hold.

Regional Variations in GST Collection

India’s different states show big differences in GST collection. These differences tell us how local economies help the country grow. Some states do well, thanks to strong industries and active markets. Others struggle, which can slow their growth.

States Leading in GST Revenue

Some states lead in GST collection, showing strong economies. They have:

- Thriving manufacturing hubs that drive tax revenue.

- A vibrant service sector catering to both domestic and international markets.

- High consumer spending driven by a growing population and urbanization.

These factors help these states do well in GST, boosting national tax collection.

States Experiencing Shortfalls

On the other hand, some states face challenges that lower their GST revenues. These challenges include:

- Limited industrial development and lack of diverse economic activities.

- Lower consumer spending as a result of economic constraints.

- Inadequate infrastructure which hinders business operations and growth.

By looking at these differences, policymakers can find ways to help these states. They can work on strategies to increase GST collection and support economic growth.

Understanding the Economic Recovery in India

The economic recovery in India is complex, with many factors at play. One key aspect is the Goods and Services Tax (GST). Recent Indian economy news shows a positive trend, with economic activity bouncing back after the pandemic. This recovery is seen in higher GDP growth, more jobs, and increased investments.

When GST performance gets better, it often shows the overall health of the economy. A strong GST collection means more consumer confidence and a boost in business across various sectors. This shows how different economic signs are connected. For example, when businesses do well and sell more, they pay more taxes. This helps the government, which then uses this money to improve the economy.

Also, GST performance gives us important clues about market sentiment. A good GST collection helps in making better policies for growth. So, we see that these numbers are linked, showing India’s economy is strong and has a lot of promise. Knowing these connections helps us predict future trends and make smart investments.

Tax Collection Insights: August 2025 Performance

In August 2025, we learn a lot about tax collection in India. We see how different sectors contribute to GST performance. This gives us a clear view of the economy.

Sector-wise Performance Analysis

Looking closely at sector performance, we find out which ones helped increase GST in August 2025:

- Manufacturing: This sector is strong, showing good activity and investment.

- Construction: Big projects have led to more tax money coming in.

- Services: Service sectors are growing, showing more demand and more taxes.

Contribution from E-commerce and Services

E-commerce is playing a big role in tax collection now. Online shopping is growing, showing how people are changing their buying habits. E-commerce platforms are adapting well to global challenges.

This change not only boosts GST performance but also shows a big shift in how businesses reach customers. It helps diversify income and make tax collections more stable.

Indian Economy News: Current Landscape

The latest news on the Indian economy shows a changing scene. This change affects GST collection in August 2025. Several factors are shaping the economic landscape.

This month, new policies have caught everyone’s eye. They aim to improve tax compliance and make financial systems digital. These changes could make GST transactions easier, helping India’s economy grow.

Looking at economic indicators, we see good signs. Manufacturing is up, and people feel more confident. This means more spending and higher GST revenues are expected.

Keeping up with current events helps us adjust to policy changes. The government is focusing on building infrastructure and promoting self-reliance. These efforts are key to keeping GST collections strong. It’s important for us to stay informed about these developments.

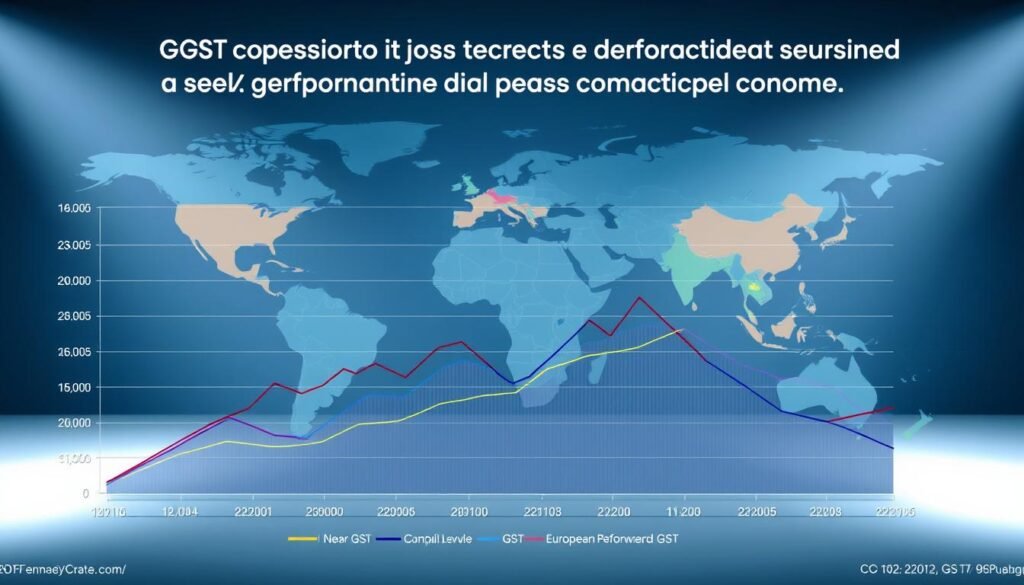

Comparative Analysis with Global GST Trends

Looking at the GST performance in India for August 2025, we see how it stacks up against the world. Many countries have started using similar tax systems. This lets us learn from them and see how we can improve.

The latest GST India August 2025 numbers show a strong growth. This is impressive, given the global economic slowdown. Countries like Australia and Canada have kept their GST collections steady. Their success can teach us about better compliance and taxpayer education.

Technology has played a big role in improving tax systems worldwide. India can use this to help its own economic recovery. By adopting digital solutions, we can make tax processes smoother, more transparent, and cut down on evasion.

Also, looking at how other countries handle taxes shows us different ways to increase revenue. This comparison helps us see where we can do better and where we can work together. By adopting global best practices, India’s GST performance can get a big boost. This will help our economy grow and recover well.

Future Projections for GST Collection in India

The future for GST collection in India looks bright. With the economy recovering, growth is expected. The government’s efforts to improve tax systems will help a lot.

Changes in how people shop online will also help. This makes tracking sales easier. Businesses adapting to global changes will also bring in more money.

Experts say GST revenues will keep going up. This is thanks to online shopping and a growing service sector. If things keep going well, GST India August 2025 might beat all previous records.

Conclusion

Looking at India’s GST performance in August 2025, we see a positive trend. This shows India is on the path to economic recovery, even with global challenges. The strong GST collection numbers show that tax policies are working well.

They also point to a rise in consumer confidence and spending. This growth in tax collection is a sign of strength in different sectors. It shows how government reforms and market changes are helping.

This information is important for talking about how to manage money better. It also opens up new ideas to make India’s economy stronger. We should keep discussing these trends to help India’s financial health and goals.

By working together, we can tackle the tough issues in tax collection. This will help India grow in a lasting way.