Did you know over 90% of Indian businesses found the current GST hard to follow? This shows we really need a change in our tax system. The GST update India 2025 is coming, with big changes like a new two-tier tax system. It aims to make things simpler and bring in more money.

This big change is all about making our tax system better. It will help us collect taxes more efficiently and make sure everyone pays fairly. With these updates, we’re ready to face the challenges of today’s business world. We’re also excited to see how it will help our economy grow and be more innovative.

Overview of the GST Update India 2025

The recent India GST update is a big change in India’s taxes. As we get closer to 2025, the government is making big changes. They want a tax system that is easier and more simplified.

This change is not just about changing tax rates. It’s about making tax rules clearer and easier to follow. This will help small and medium businesses a lot.

The changes will have a big effect on the economy. The GST reform 2025 will make tax collection and following rules easier. Experts think this will help the economy a lot.

This update shows the government’s plan to update the tax system. They want to make taxes clear and easy for everyone. This will help the economy grow and new ideas to come up in different areas.

What is the New Two-Tier Tax Structure?

The new two-tier GST rates change India’s tax system. They aim to make taxes fairer. Goods and services are split into two groups.

Basic needs have lower taxes. Luxury items pay more. This helps lower-income families and makes sure luxury buyers pay their share.

With GST reform 2025, the goal is clear. It wants a fair tax system. Basic things get lower taxes, while non-essentials pay more.

This change makes taxes more understandable. It also makes things more transparent. Consumers know what taxes they pay on different products.

This new tax system is forward-thinking. It helps both consumers and businesses. As we explore this new system, we’ll see how it affects different parts of the country.

Key Reforms Announced in the GST Update

The GST rate changes have brought a new era for businesses and consumers in India. These reforms aim to make tax simpler and lower prices. They have big effects on both sides, changing the landscape.

Impact on Businesses

Businesses now face new rules that need them to adapt. They must change how they work to stay competitive. This might mean spending on new systems and training.

In the end, this could make things more efficient. Retail and manufacturing are already changing their prices because of these rules.

Impact on Consumers

The goal is to help consumers by making things cheaper. As prices change, people might spend more. This could make everyday items more affordable for more people.

Experts think this could make people more confident and ready to spend. This is good news for the economy.

| Sector | Business Compliance Effects | Expected Consumer Effects |

|---|---|---|

| Retail | New pricing strategies implemented | Lower prices on essential goods |

| Manufacturing | Streamlined operations and processes | Enhanced consumer purchasing power |

| Services | Adaptation to service tax adjustments | Potential reduction in service costs |

Understanding the Two-Tier GST Rates

The two-tier GST rates are changing how India taxes goods and services. They make it easier for both buyers and sellers to understand taxes. This change is key as we look at GST reform 2025 and better compliance.

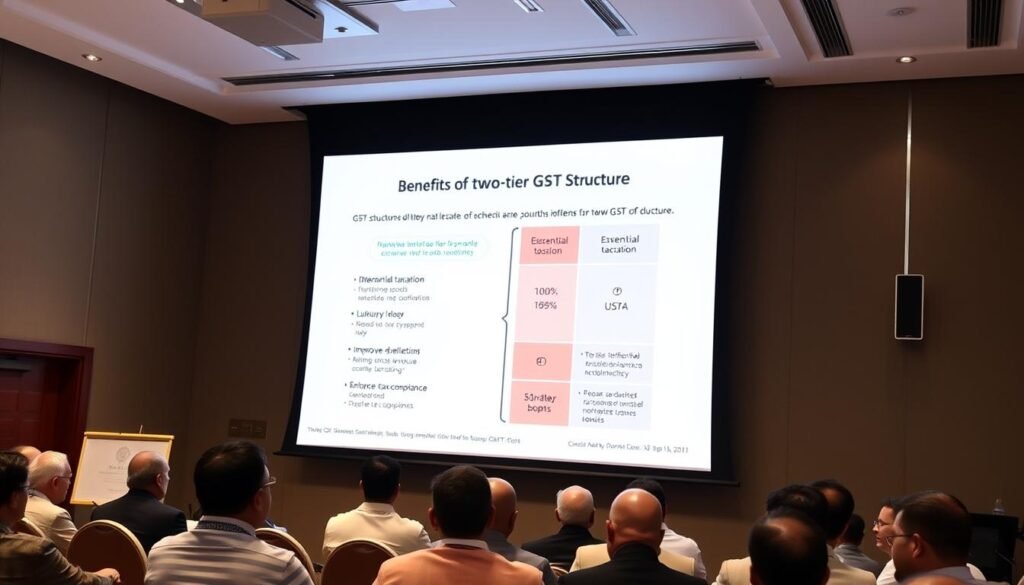

Benefits of the Two-Tier Structure

Businesses will find it easier to follow tax rules with the two-tier GST rates. A simpler tax system means less confusion. This makes it easier for businesses to handle their taxes.

Also, shoppers will see lower prices on important items. This can help people buy more, which is good for the economy. Experts think this could help the economy grow.

In short, the two-tier GST rates are a smart move. They help solve problems with a complex tax system. We can learn a lot from both theory and real-world examples about how these changes will affect India’s economy.

GST Reform 2025: Implications for Compliance

The GST reform of 2025 will change how businesses in India follow rules. It’s key for companies to check their tax management. They need to know the new rules and how they affect different areas.

When rules change, businesses must quickly adjust. Not following new rules can cause big fines. This can hurt a company’s work. But, it’s also a chance to make work better and more efficient.

Here are important things for businesses to do to follow the GST reform:

- Reviewing existing tax processes: Companies should look at their tax systems to see if they match the new rules.

- Training staff: It’s important to make sure employees know the new rules. This helps avoid problems.

- Upgrading technology: Using new software can help manage rules better.

- Collaboration with professionals: Working with tax experts can help understand the new rules better.

Having good plans for adapting to the GST reform can help a lot. Businesses need to keep checking and making changes. This way, they can meet the new rules.

GST Rate Changes and Their Impact

The recent GST rate changes bring big changes to India’s economy. These changes will affect many areas, changing how markets work and how people shop. The goal is to make taxes easier and help the economy grow.

These changes might change how people spend money. Lower taxes on basic items could make people buy more. But, higher taxes on fancy items might make people buy less.

Businesses will see different things depending on what they do. Some might do better with lower taxes. Others might face higher costs with higher taxes. Here’s a table showing what might happen in different areas:

| Sector | GST Rate Change | Expected Impact |

|---|---|---|

| Essential Goods | Decreased | Increased Demand |

| Luxury Goods | Increased | Decreased Demand |

| Services | Stable | Minimal Impact |

| Manufacturing | Variable | Cost Impact Depending on Inputs |

In short, these GST rate changes will affect the whole economy. They will change how businesses and people act. Watching these changes closely will help us understand the two-tier structure impact better.

GST Compliance India: New Regulations and Guidelines

The GST compliance in India is changing with new rules. These changes help make things easier for businesses. It’s key for companies to follow these guidelines to stay ahead.

Getting ready for these updates means setting up strong onboarding steps. This helps businesses smoothly adjust and meet the new standards.

Onboarding for Businesses

Good onboarding means learning and using the latest GST rules. Companies need to train their staff well on these rules. This training is very important.

It’s also important to have clear ways to talk and resources for onboarding. This helps employees understand their part in keeping things compliant.

Challenges in Compliance

Companies will face many challenges with the new GST rules. One big issue is updating technology for better data handling. This takes money and time.

Another big problem is setting up good controls to avoid breaking rules. Businesses need to plan ahead and keep learning. They should also make sure they have the right resources.

| Challenge | Description | Potential Solutions |

|---|---|---|

| Technology Upgrades | Investments in new software systems to manage compliance and reporting. | Conducting regular audits and providing training on new tools. |

| Staff Training | Ensuring all employees are aware of the latest GST guidelines and their responsibilities. | Implementing a continuous learning framework that keeps staff updated. |

| Internal Controls | Maintaining accurate records to avoid non-compliance penalties. | Developing clear procedures and accountability measures for documentation. |

Effects on the Automobile Sector under GST Reform

The GST reforms have changed the game for the car industry, focusing on electric vehicles. The government wants to help more people buy electric cars. This is good news for car makers and buyers.

It’s important to understand these changes. They can lead to new ideas and change how the industry works.

Incentives for Electric Vehicles

Electric car incentives show the government’s push for green cars. They offer lower GST rates, subsidies, and tax breaks. These make electric cars more affordable.

| Incentive Type | Description | Potential Benefits |

|---|---|---|

| Reduced GST Rates | A lower GST rate on electric vehicles enhances affordability. | Increased consumer adoption and growth in sales for manufacturers. |

| Subsidies for Consumers | Direct financial assistance for purchasing electric vehicles. | Lower upfront costs lead to wider market penetration. |

| Tax Rebates for Manufacturers | Tax relief for companies developing electric vehicle technologies. | Encourages investment into innovative solutions and research. |

These incentives could change how people buy cars and push the industry to grow. They also help the environment.

Revised MRPs and Their Significance in the New System

The new GST framework brings big changes to India’s prices. Businesses must now adjust their prices to fit the new rules. This includes understanding the two-tier system better.

Revised MRPs mean more than just numbers. They show a big change in how we see value in products. This could lead to lower prices on important items, changing how we shop.

Companies need to think about a few things when setting prices:

- They should look at what others are charging to attract customers.

- They need to be clear about prices to gain trust.

- They should also work on making their supply chains more efficient to save money.

Lower prices on key items make the market more competitive. This is good for both businesses and shoppers. As things settle, we’ll see new ways of pricing that focus on what customers want.

Biometric Authentication in GST Compliance

As part of the ongoing GST reforms in 2025, we welcome biometric authentication. It’s a key part of making compliance better. This new tech makes processes smoother and tax collection more accurate.

By using biometric systems, businesses can protect themselves. They also help make tax systems more open and honest.

Ensuring Transparency and Accountability

Biometric authentication in GST compliance can cut down on fraud. It uses unique traits like fingerprints or facial recognition. This makes security better.

This change also makes tracking transactions more accurate. It leads to better accountability in tax reporting.

Businesses using biometric technology will see many benefits:

- Improved security against identity theft and fraud.

- Faster processing times for transactions.

- Increased confidence from stakeholders due to measurable transparency.

In summary, the GST framework is moving towards better technology. Biometric authentication is a big step forward. It’s in line with global trends, making tax systems more efficient and trustworthy.

Future of GST in India: Trends Ahead

Looking at the future of GST in India, we see ongoing reforms shaping taxation. These changes aim to align with global standards, making things easier for everyone. This move will help India’s economy grow and attract more foreign investment.

The digital world is changing how we deal with taxes. New systems and data tools are making tax work better for businesses. These changes will keep GST relevant in our fast-changing world.

We see a future where GST helps the economy grow and encourages new ideas. By using new tech and improving rules, GST will change for the better. It will help both businesses and people. The journey might be tough, but the benefits are worth it.